Pathway to College Series: Financial Aid 101

|

|

|

Money that does not need to be repaid

|

Grants & Scholarships

Grants are given based on financial-need, while scholarships are merit-based and awarded to students based on academic achievements, extracurricular activities, and fields of study.

Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need. The maximum Federal Pell Grant for the 2022–23 award year (July 1, 2022, through June 30, 2023) is $6,895. The amount an individual student may receive depends on a number of factors. |

Work Study

A work-study job gives you the opportunity to earn money to help pay for your educational expenses.

The Federal Work-Study Program allows you to earn money to pay for school by working part-time. You’ll earn at least the current federal minimum wage. However, you may earn more depending on the type of work you do and the skills required for the position. Your total work-study award depends on when you apply, your level of financial need, and your school’s funding level. |

Money that does need to be repaid

Loans

Student loans are real loans (like a car or a home loan) that need to be repaid with interest.

- Direct Subsidized Loans: Do NOT accrue interest while the student is in school. These are for undergraduate students who have financial need. A student must be enrolled at least half-time. The maximum loan amount is $5,500, depending on grade level and dependency status.

- Direct Unsubsidized Loans: DO accrue interest while the student is in school. These are for undergraduate students who are enrolled at least half-time. Financial need is not required. The maximum loan amount is $12,500 (less any subsidized amounts received for the same period), depending on grade level and dependency status.

- Direct Plus Loans: DO accrue interest while the student is in school. These are for parents of dependent undergraduate students who are enrolled at least half-time. Financial need is not required. The maximum amount is the cost of attendance minus any other financial aid received. Please be very careful before accepting Direct Plus Loans.

Did you know that filling out a financial aid application is a high school requirement? |

Beginning with the Class of 2022, all high school graduate must submit a FAFSA, TASFA or sign an opt out form. An opt form is only advised if a student is considering a gap year, joining the military, or going into the workforce immediately after high school.

|

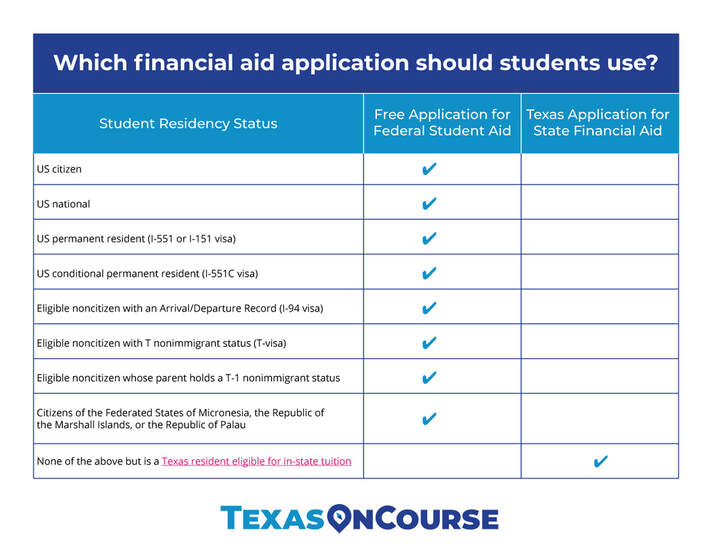

which application should I use IN ORDER TO RECEIVE FINANCIAL AID?

Students will fill out EITHER the Free Application for Federal Student Aid (FAFSA) or Texas Application for State Financial Aid (TASFA) based on their residency status. There is no need to fill out both applications. Use the following document to help you decide which application to use.

Is there a way to estimate aid without filling out the FAFSA or TASFA?

The Federal Student Aid Estimator provides an approximation of what federal student aid you may be eligible to receive, your Expected Family Contribution (EFC), and can help you understand your options to pay for college or career school.