What is the TASFA?

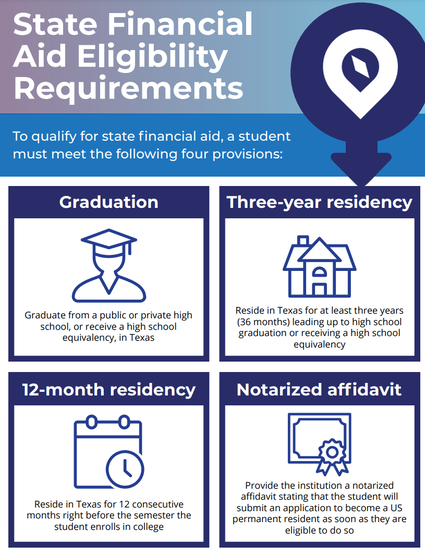

Who Qualifies for TASFA?Texas residents who do not qualify for financial aid using the FAFSA. See the specific residency provisions in the graphic to the right.

|

WHERE CAn I FIND THE TASFA?

At this time, the state of Texas only has a paper (PDF) version of the Texas Application for State Financial Aid. Although an online TASFA is expected at a later date, students should submit a paper version by the January 15 priority deadline. It is recommended that students type their responses directly into the PDF and create a different digital file for each school to which they wish to apply.